Small Saving Schemes

Warning: Trying to access array offset on value of type null in /home/u852199908/domains/sskfinsol.com/public_html/wp-content/plugins/elementor-pro/modules/nav-menu/widgets/nav-menu.php on line 1453

Warning: Trying to access array offset on value of type null in /home/u852199908/domains/sskfinsol.com/public_html/wp-content/plugins/elementor-pro/modules/nav-menu/widgets/nav-menu.php on line 1466

Warning: Trying to access array offset on value of type null in /home/u852199908/domains/sskfinsol.com/public_html/wp-content/plugins/elementor-pro/modules/nav-menu/widgets/nav-menu.php on line 1477

Warning: Trying to access array offset on value of type null in /home/u852199908/domains/sskfinsol.com/public_html/wp-content/plugins/elementor-pro/modules/nav-menu/widgets/nav-menu.php on line 1490

Menu

Small Saving Schemes are the set of saving instruments managed by central government with an aim to encourage citizens to save regularly as per their needs. The concept of savings as a national income gained importance over the years. Savings plays an important role in the mobilization of resources for development expenditure at the same time investors get safety, security, liquidity and good returns on their investment. In developing economy, this fund is available to the government for the development work. Therefore, small saving schemes has got a very important roll to play in the sphere of investments.

Highlights of Small Saving Schemes

- Returns – Small saving schemes provides returns that are generally higher than bank fixed deposits

- Government Operated – Small saving schemes comes with a sovereign guarantee. They ensure timely payment of not only interest but also maturity.

- Tax Benefits – All these schemes are entitled to some income tax benefits. The actual amount of benefit varies from scheme to scheme.

- Affordable – These schemes are affordable to even people of lower income class because of minimum investment limit, which is as small as Rs 100. As these schemes are operated through post offices and nationalized banks, they are accessible to the investors staying in small towns and cities.

- Liquidity – Most of these schemes offers provision for early withdrawals and also gives loan facility at a lower rate of interest.

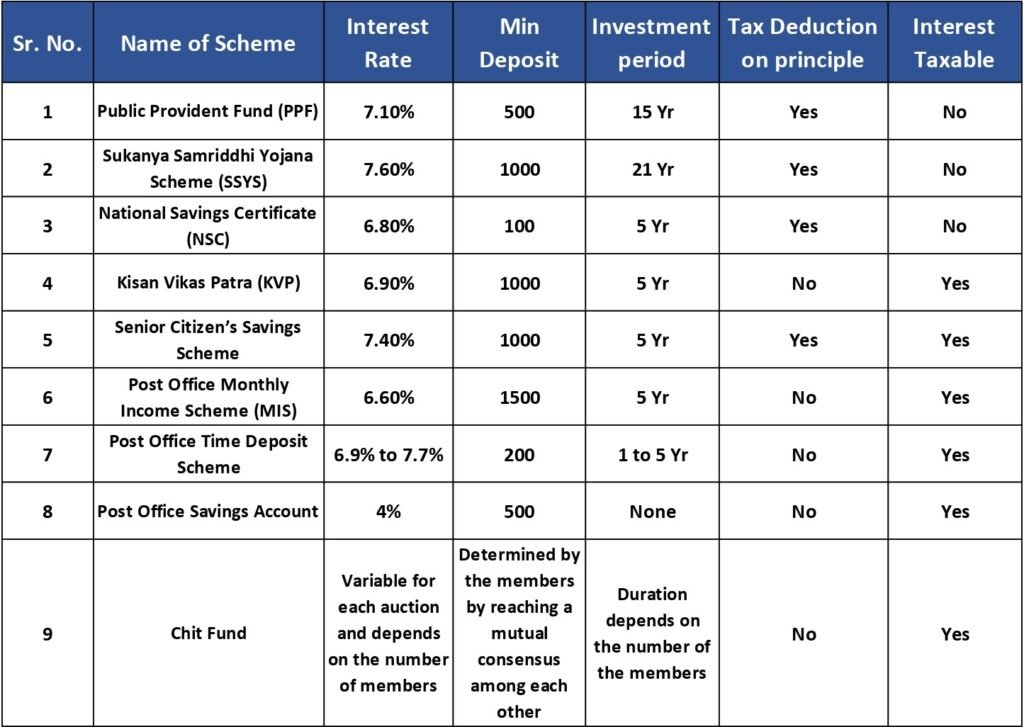

List of Top performing small saving schemes in India and their features at a glance