Tax Regimes available in India

Warning: Trying to access array offset on value of type null in /home/u852199908/domains/sskfinsol.com/public_html/wp-content/plugins/elementor-pro/modules/nav-menu/widgets/nav-menu.php on line 1453

Warning: Trying to access array offset on value of type null in /home/u852199908/domains/sskfinsol.com/public_html/wp-content/plugins/elementor-pro/modules/nav-menu/widgets/nav-menu.php on line 1466

Warning: Trying to access array offset on value of type null in /home/u852199908/domains/sskfinsol.com/public_html/wp-content/plugins/elementor-pro/modules/nav-menu/widgets/nav-menu.php on line 1477

Warning: Trying to access array offset on value of type null in /home/u852199908/domains/sskfinsol.com/public_html/wp-content/plugins/elementor-pro/modules/nav-menu/widgets/nav-menu.php on line 1490

Menu

Tax Regimes available in India

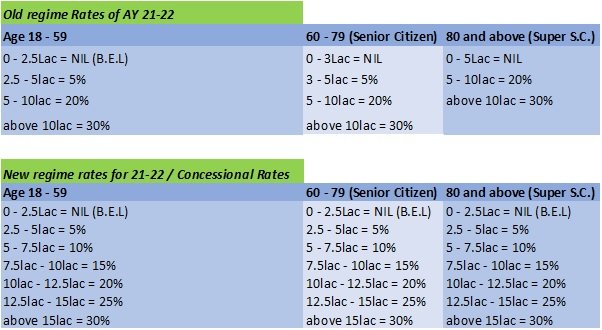

Finally, about the Tax regimes available in India. Union budget 2020 introduced New Tax regime in the system while continuing with Old Tax regime as well, so the tax payer has the choice to choose between the two. In order to decide which regime would be more beneficial to a taxpayer, one needs to make a careful analysis and comparison.

The new tax regime is different in two ways from the old one. First, it has more slabs with lower tax rates. And second, all the major exemptions and deductions mentioned above which are available to taxpayers in the existing (old) tax regime are not allowed if the new tax regime is chosen.

The Income Tax slab rates for both the New and Old Tax regimes

Lastly, just to reiterate, do not wait till the 11th hour to do your tax planning exercise. while you have host of tax-saving investment options available under Section 80C and other sections, choose the tax saving investment option based on your Risk Appetite, Time Horizon and Return Requirement.

Do not invest in insurance just for the purpose of Tax Saving. Change yourself from “Tax Saving to Tax Planning”. Take the help of professionals for the better results.